cryptocurrency tax calculator india

ZenLedgers Bitcoin tax calculator is one of the best crypto tax calculators on market today. If the total taxable income of an investor excluding short-term gains is below the taxable income that is Rs 25 lakh one can adjust this shortfall against the short-term gains.

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

For example you have bought some Cryptocurrency units in April 2018 for Rs 80000 and sold them for Rs 120000 in December 2019.

. Under direct taxes gains from. The purchase date can be any time up to December 31st of the tax year selected. Indias first crypto accounting and tax tool which has been vetted by a Chartered Accountant.

Learn and stay informed about cryptocurrency in India. Bittax uses a tax planning algorithm mechanism and helps you organize and manage all your tax liabilities and profits keeping in mind the standard protocols of IRS. Enter the purchase date and purchase price.

Catax is Indias First and best cryptocurrency tax software for easily calculating your crypto taxes. Enter your total buying price of all the cryptocurrencies that you acquired. Please refer to the example below.

Finance Minister Nirmala Sitharaman said that any income from transfer of any virtual digital asset. Short-term capital gains on sale of cryptos would need to be reported in CG schedule of ITR-2ITR-3 for FY2020-21 under STCG on assets other than at A1 or A2 or A3 or A4 or A5 above. Cryptocurrency Tax Calculator 2022.

Repeat for all Bitcoin or cryptocurrency sales within the tax year selected. How To Use The India Cryptocurrency Tax Calculator. Get Started For Free.

Use our Crypto Tax Calculator. In the Union Budget 2022 crypto assets have been classified as virtual digital assets. Make sure the sale date is within the tax year selected.

Integrates major exchanges wallets and chains. BearTax - Calculate Crypto Taxes in India. That means all your income from crypto transactions in FY 2022-23 will.

If your income includes income from sources other than cryptocurrency or NFTs tax on such income needs to be calculated based on the applicable income tax slab rates. As per budget 2022 you will have to pay tax 30 on profit on the sale of any virtual digital assets cryptocurrency. Because there is no further deduction that will.

1 TDS on Crypto Assets. The tax shall be paid by the individual who has received any profit on cryptocurrency transactions irrespective of whether the gain is short term capital. The holding period is less than 36 months.

You can not save tax if you will trade in cryptocurrency in India after 01042022. It may sound like a negative news but lets dig in a little deeper and find out what are the facts about cryptocurrency tax in India. The income tax liability calculated above is only for income earned from bitcoins.

Covers NFTs DeFi DEX trading. There will be a 30 tax on cryptocurrency in India. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

Grand Unified Accounting report GUA shows every transaction and can be tweaked or modified to achieve the best potential tax result for the investor. For example if you bought Rs 50000 worth of Bitcoin BTC and Rs 60000 worth of Dogecoin DOGE enter 110000 in the Total Buying Price input field. ZenLedger has features that are the best in class including.

According to the Budget 2022 announcement Tax Deducted at Source TDS will be imposed on payments for the transfer of crypto assets at a rate of 1 for transactions over a certain threshold. In the budget 2022 new rules related to the taxation of cryptocurrencies have been introduced. According to the Economic Times the tax burden on cryptocurrency investors could rise to anywhere between 35 and 42 percent on crypto assets.

The government may also levy 18 Goods and Services Tax on transactions on foreign cryptocurrency exchanges. Therefore if crypto earnings are not reported and offered to taxes it. Same as like you need data for calculating other Capital Gain Tax.

Now when you file your ITR for 2023-24 you need to calculate your tax liability for. Tailored as per the Indian tax laws the algorithm provides an accurate report of your crypto gainslosses for a. It is kept at a flat 30 on income from the transfer of digital assets such as cryptocurrencies.

The ClearTax Bitcoin Tax Calculator shows you the income tax liability on cryptocurrency income. India has also considered a 2 equalisation levy on transactions with foreign crypto. Indian tax laws are inclusive ie any and every income earned from any source is taxable unless explicitly exempted.

The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and l ong term capital gains. According to the Budget document 30 tax on cryptocurrency and other VDAs would be applicable from Assessment Year 2023-24. Simple Crypto taxes for everyone.

In addition to 30 of the tax you also need to pay cess at 4 of the tax amount. However the Government has not clarified what this threshold will be. The calculator is based on the principle of taxation enumerated by the IRS in the latest notice.

To calculate tax on cryptocurrency you have to deduct the purchase price from the selling price of cryptocurrencies you hold and calculate 30 of the value. By this definition earnings from crypto are also taxable. Support popular cryptos like bitcoin ethereum and more.

30 tax on cryptocurrency income brings clarity legitimises crypto say experts. BearTax is integrated with more than 25 crypto exchanges and just like any other tax software calculates all your assets gains losses imports data and files your tax document. Long-term capital gain on crypto assets attract a capital gains tax of 20 per cent where the investor will get the benefit of indexation.

Further the return of income needs to be filed before the due date to claim carry-forward of capital losses if any for set-off in subsequent 8 years against. Following are the steps to use the above Cryptocurrency tax calculator for India. As per the IRS cryptocurrency or any virtual digital transactions are taxable by.

Taxation on Cryptocurrency These examples calculate taxes for the FY 2022-23 for a person. The gains are short-term capital gains of Rs 120000 Rs 80000 Rs 40000. Enter the sale date and sale price.

Cryptocurrency Tax Calculation 2022 What Will Be Taxed What Won T How And When Explained The Financial Express

Explained How Will Crypto Taxation Work In India

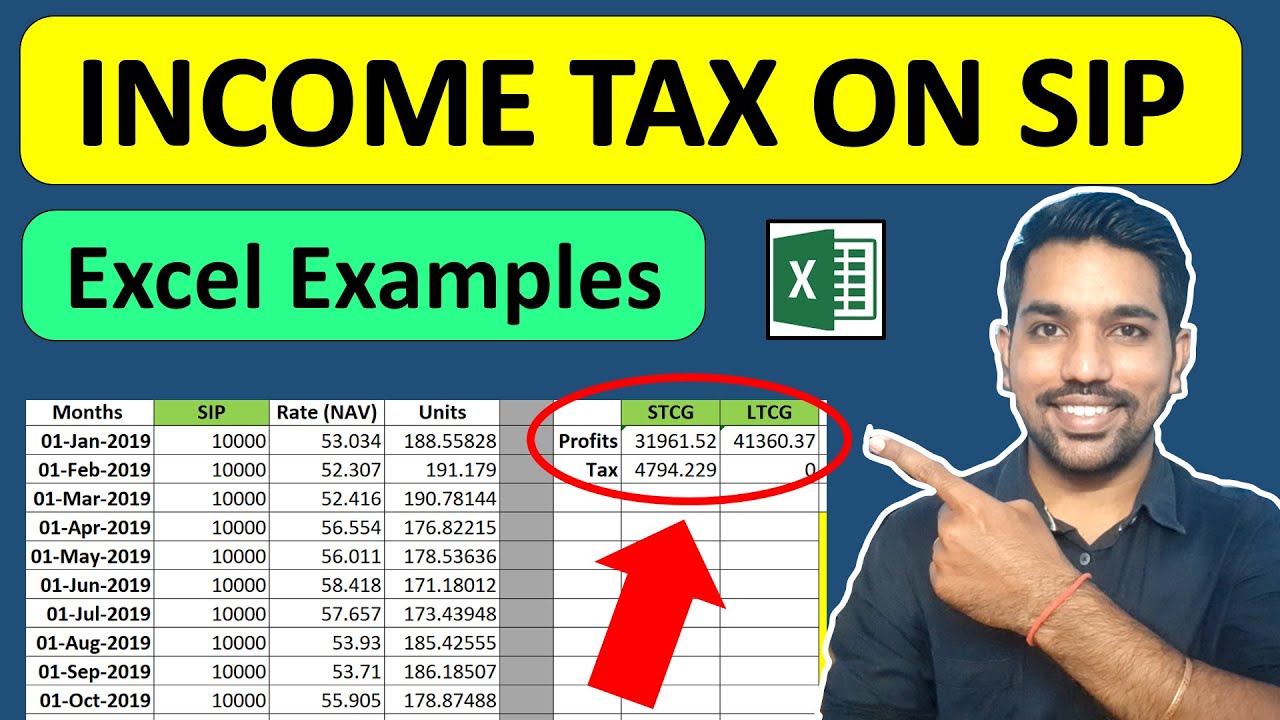

Crypto Tax Calculator India Income Tax Calculation On Cryptocurrencies Nft Explained Youtube

Petition To Reduce 30 Crypto Tax In India Garners Over 15 000 Signatures In Hours Finbold

What S Your Tax Rate For Crypto Capital Gains

Crypto Tax Calculator India Income Tax Calculation On Cryptocurrencies Nft Explained Youtube

Cryptocurrency Tax Guides Help Koinly

Income Tax Calculator How Cryptocurrency Investors Will Be Taxed From April 1 Mint

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

Crypto Tax India Ultimate Guide 2022 Koinly

Capital Gains Tax Calculator Ey Us

Crypto Tax Calculator India Income Tax Calculation On Cryptocurrencies Nft Explained Youtube

Crypto Tax Calculator India Income Tax Calculation On Cryptocurrencies Nft Explained Youtube

Crypto Tax India Ultimate Guide 2022 Koinly

Cryptocurrency Tax Guides Help Koinly

Bitcoin Tax Calculator Calculate Your Tax On Bitcoin

Cryptoreports Google Workspace Marketplace

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win